The Ultimate Guide to Car Accident Cases in Pennsylvania

(2nd Edition)

2525 West 26th Street, Suite 200 † Erie, PA 16506 † (814) 833-7100

Eric Purchase, Tim George & Craig Murphey

Purchase, George & Murphey, P.C.

(814) 833-7100

Your Roadmap to Justice

A Practical Guide for Anyone Harmed by a Careless Driver

“Speak English! I don’t know the meaning of half those long words, and I don’t think you do either.”

– Eaglet in Alice in Wonderland

The authors of this handbook are lawyers who help people who are injured by careless drivers in Pennsylvania. (You can read more about us later. The focus of this handbook is about you, your family and the best way ahead for you after a car accident in Pennsylvania.) As lawyers, we are keenly aware of the affliction that we both contracted while in law school. You know, the one that trained us to think and talk like lawyers – and worse – write like lawyers. We promise that this handbook will not read like a lawyer’s brief or a court opinion. We know that you are not a lawyer or a judge. You and readers like you are just like the many clients and their families that we have helped over the years. And we have shared with them much of the same information that you will find here.

We Use Plain English (But We’re Still Lawyers)

What is a book written by lawyers without a disclaimer? One certainty in law (and in life) is that no two cases are the same – not even two car accident cases (even two that happen at the same intersection in the same week with the same injuries). Each case

turns on its own unique facts and circumstances. Nothing you read here should be considered legal advice. We simply want you to understand the proper mindset, the process and the pitfalls of car accident cases in general. Legal advice comes only from a lawyer in the context of a lawyer-client relationship. We simply want to arm you with good information. More information is always better than less information. Better information results in smarter decisions.

About the Road Ahead:

Blind Turns & No Guardrails

You Need More Than a Slingshot Against This Modern Day “Goliath”

We know about honest people who suffer genuine economic and other harm at the hands of careless drivers. We understand that the playing field tilts in favor of the insurance industry. We know that good people, unaware of the battle they face, have legitimate claims denied, delayed, disputed or devalued by big insurance companies. The vast financial and human resources available to the insurance companies create a modern-day battle between David and Goliath.

We firmly believe that an experienced and committed lawyer is the best asset an injured person can have. The insurance industry seems to agree with us. One insurance industry organization advises consumers that they should consult with an attorney only “as a last resort.” Frankly, we think there is no higher form of flattery than seeing our adversary desperately try to steer clients away from us.

Unfortunately, we see many good car accident cases get wrecked due to mistakes that could have been avoided had the injured party consulted with a lawyer. Our purpose in writing this book is to help level the field (at least somewhat), make you aware of the mistakes that can ruin your case and, in the end, join you in the pursuit of justice. We begin by identifying several wrongheaded beliefs about injury cases.

The Bull & the Vegetarian (And Other Cautionary Tales)

“Expecting the world to treat you fairly because you are a good person, is a little like expecting the bull not to attack you because you are a vegetarian.”

– Dennis Wholey, host of This Is America

If you are harmed by a careless driver it would be understandable for you to believe that you’ll be treated fairly. You did nothing wrong, after all. It was the other driver who ran a red light or ignored the stop sign or was texting or was drunk. You work, raise children and pay your taxes. The insurance company for the guy that slammed into you will pay your medical bills, fix your car, reimburse your lost income, and make a fair settlement offer, right?

Unfortunately, your pursuit of justice is doomed to failure from the beginning if, like the vegetarian in the bull ring, you assume that you will be treated fairly by the insurance company just because you did nothing wrong, suffered harm and are a good person. The reality of seeking fair compensation for your injury is that it is a process that requires specialized knowledge in the management of multiple insurers (e.g., your own insurance company, the insurance company for the “at-fault” driver, health care insurers, and the like); careful collection, organization and presentation of the records and liens associated with the claim; and often the real threat of trial in the event of an unsuccessful settlement effort. Failure to properly prepare for and address these complexities will harm – or even completely ruin – your case.

Here are some other mistaken beliefs or “myths” about accident cases.

- The insurance company for the driver that caused the accident is obligated to pay your medical bills and repair the damage to your car.

- Just because you were hurt in an accident which was caused by the other driver, an insurance company will pay your medical bills as soon as your hospital, doctor or physical therapist sends you a bill.

- When the insurance company for the careless driver asks you to provide a recorded statement, you must give a statement or else lose your rights.

- When buying car insurance, the “limited” tort option always saves you money.

- The yellow pages are an excellent place to find a lawyer for your case.

- If a lawyer advertises on TV or has big, colorful advertisements on the cover of the telephone book or on billboards or has a full-page ad (or pages of ads) in the yellow pages, he must be good.

- It is a good idea for your lawyer to refer you to a doctor.

- There is a “standard” fee agreement for all accident cases.

- Juries in Pennsylvania are generous in awarding money damages to innocent people harmed by careless drivers.

- Our civil justice system is like a “lottery” that helps lazy people “get rich.”

Big Insurance Companies Behaving Badly

We know that some of you might still think that you will be treated fairly by the big insurance companies just because you did nothing wrong, suffered harm and are a good person. (After all, you say, “David beat Goliath.”) So, we now provide a sampling of our cases in an effort to illustrate our experiences with various insurance companies. These cases provide a context within which you can see how the recurring tactics of “deny, delay and dispute” can frustrate efforts to make things right when a careless driver causes harm. Every case is different and the results in one case do not predict the outcome of any other case, including yours. With this disclaimer in mind, consider these real cases.

The Case about the Insurance Company that Sued a 9- Year-Old Boy

On January 13, 2006, a 9-year-old boy was riding his bicycle on Plum Street in Erie, Pennsylvania. As he peddled, an elderly woman was driving her car west on 11th Street and approaching the intersection with Plum Street. The elderly driver had the right of way at the intersection, but she also had a clear view of Plum. She would have seen our 9-year-old client on his bicycle – had she just looked. Despite her unobstructed view, the elderly motorist drove her car into our young bicyclist, and failed even to brake before hitting him. She explained that she never saw the bicyclist and stopped later only because she felt a “bump.”

Our young client had several injuries, including a life-threatening skull fracture. Fortunately, all of those injuries healed with time, but the early going was extremely frightening and the recovery was painful for the boy and his mother. The elderly driver was not harmed, although our client (or his bicycle) put a dent in her bumper.

Amazingly, this case came to us because the elderly driver’s insurance company filed a lawsuit against the 9-year-old boy and his mother for the damage caused to the elderly driver’s car. The insurance company actually tried to convince our client’s mother to sign a release without paying a dime for the boy’s injuries. Fortunately, our client’s mom suspected the insurance company wasn’t being fair to her and she came to us for help.

After our involvement, the case which began with the insurance company suing the 9-year-old boy ended with the insurance company (and not the boy or his mother) paying to settle the case. Later, our client’s underinsured motorist carrier also paid an additional sum to make things right for the child.

The Case about the Insurance Company that Didn’t Know its own Policy

On December 20, 2001, an uninsured driver crossed the center line and hit a car being driven by a 56-year-old woman. The collision resulted in injuries to her knees, including a meniscus tear in one that led to arthroscopic knee surgery. When that procedure and more physical therapy failed to improve her condition, she had right knee replacement surgery. She incurred medical bills which exceeded the amount of the medical benefits coverage she purchased from her insurance company. The medical liens in the case (the amount she would have to repay from any settlement) totaled $41,269.19.

Her insurance company initially told her that she had only $50,000.00 in coverage. About two years after the accident (and after the first knee replacement) her insurance company offered to settle her injury claim for $7,798.00. The lawyer who she initially hired refused to represent her anymore because it appeared there simply was not enough insurance coverage to compensate her and repay the medical liens.

On her own and without a lawyer, the woman requested a report from the orthopedic surgeon who performed her right total knee replacement. In his report, he expressed the opinion that the car accident “aggravated” the previous arthritis in her knees and “accelerated the need” for both knees to be replaced. He said that he planned to replace the left knee after her right knee was sufficiently healed. The woman provided this report to her insurance company, along with a letter in which she wrote the following:

I do not want to hire a lawyer or file suit against the insurance company; however, the value of my bodily injury and work loss claims exceeds the limits available under my policy. Please be fair with me. I have not been able to work and need another knee replacement. I implore you to pay the uninsured motorist limits of

$50,000.00 as well as the work loss limit in the amount of $25,000.00 so that I can pay all of these medical bills, have another knee replacement and begin to make a living again.

In response, the insurance company again offered to settle her case for only $7,798.00. The woman then hired us.

We determined that rather than $50,000.00 in coverage, our client actually had $100,000.00 in coverage. (It took the insurance company 6 more months to confirm this fact in writing). After doing so, the insurance company increased the offer to settle the case to $20,000.00. We refused to settle. One month later, the insurance company offered to settle the case for the policy limit of $100,000.00.

The Case of the Insurance Adjuster who said, “We will not pay thousands.”

On August 28, 2007, our client was stopped at a red light in Allegheny County when an inattentive defendant hit him from behind. Our client was taken to the hospital with complaints of spine pain and tingling and numbness in his arms and legs.

The careless driver that caused the collision was insured. The other guy’s insurance company responded to us by saying that they “weren’t going to pay thousands” to settle this claim. We thought otherwise.

Our client, who was 63 years old at the time, was diagnosed with strains and sprains and contusions. Unfortunately, his problems didn’t resolve but worsened with time, despite the fact that he always followed his doctor’s advice and tried his best with physical therapy. Within a year of the accident, our client’s doctor determined that his injuries from the accident were permanent and disabling. He would not, his doctor found, be able to return to work.

Our client had worked for 38 years (the last 20 without missing even one day of work) before the accident. And though he was nearing retirement, he still planned to work several more years. This “forced” retirement due to his disability was a huge blow for him and his wife.

We worked over the next two years to make sure the doctors had a fair opportunity to explain our client’s condition and we made sure that the other guy’s insurance company understood the impact the accident had on the life of our client and his family. In the end, the case which began with the other guy’s insurance company saying they weren’t going to pay thousands to settle ended with that insurance company paying $225,000.00 to settle before trial.

The Case of the Insurance Company that Cried, “Limited Tort!”

Our experience has been that insurance companies are no more likely to be fair on smaller claims than they are on large claims, even when the injured person is one of their own insureds. On December 2, 2005, a driver made a left turn in front of a snow plow which caused a collision. The passenger in the car was not badly injured, but the impact caused her to lose one tooth and fracture another, which required several painful dentist visits.

The same insurance company had issued separate polices of insurance to both the driver and the passenger, who later became our client. At first, the injured passenger thought that because her claim was a small one that she could handle it herself. After all, she thought, “They are my insurance company too, and they will to be fair with me.”

Amazingly, the insurance company told our client that the Limited Tort option applied to her case and offered her nothing to settle the case.1 The problem was that the Limited Tort option plainly did not apply in the case. What made matters worse was that Erie Insurance had all of the facts necessary to figure that out.

After the insurance company told her in “numerous conversations that the Limited Tort option applies to you” and refused to offer her any compensation for her pain, inconvenience and discomfort, she called us.

It was a small case, but we were convinced that insurer was dead wrong. After we filed suit, the case in which the insurance company initially and repeatedly offered nothing to the woman without a lawyer, was settled favorably for our client.

The Case that (Mysteriously) Grew Tenfold

On April 15, 2005, our client was a passenger on the tailgate of a pickup truck being driven by the defendant. The defendant was driving very slowly along an old logging trail while our client and others in the back looked for firewood. Apparently as a prank, the defendant “punched” the gas and our client was thrown out of the truck.

Our client suffered a displaced fracture of her left ankle. Witnesses at the scene said that her foot was turned around the wrong way. Despite her obvious injury, the defendant initially refused to help take her to the hospital. (He was the only one in the group who knew how to get to the hospital.)

1 For more on the Limited Tort option, see the section titled “Does Choosing Limited Tort Really Save You Money?”

When she finally got to the hospital, they did their best to treat her fracture conservatively with a cast, but ultimately her leg required a surgical repair. The fracture was stabilized with bone screws and a plate. Ultimately, she had a good recovery although her ankle still gets sore and swollen when she overuses it or the weather changes.

The insurance company for the defendant tried to blame our client for falling out of the truck. They offered her only $7,500.00. We were convinced that the insurance company had grossly undervalued our client’s claim and so we pressed on with a lawsuit and prepared for trial.

When the case got closer to trial, we received a ruling from the Court which permitted us to seek punitive damages against the defendant. In the end, the case settled before trial. The amount recovered by our client, including a $25,000 payment by our client’s underinsured motorist carrier, was 10 times what was offered in the beginning.

The

Bottom Line. These stories illustrate

the fact that when you seek justice after an accident, battle lines are drawn.

The big insurance companies are neither your allies nor your battle buddies.

The playing field is tilted in their favor due to many factors, including the vast financial

and human resources

available to them, your relative inexperience with the process and the

“myths” associated with accident cases. Only after considering these things can

you make an informed decision about whether you need a lawyer to join you in

your pursuit of justice.

Meaningless Lawyer Advertising, Frivolous Claims & Other Roadblocks to Justice

Big insurance companies behaving badly are not the only roadblocks to justice for people in Pennsylvania who are harmed by careless drivers. Your pursuit of justice can be made more difficult by meaningless lawyer advertising, frivolous claims filed by others, and lazy or inexperienced lawyers who settle cases on the cheap to get a quick fee. The already difficult challenge of finding the right lawyer after an accident is made even more difficult when sifting through the seemingly endless pages of “empty slogans” found in the yellow pages. Justice can be delayed or denied while waiting for your day in court because frivolous lawsuits crowd the dockets. And lawyers who fear the prospect of trial often twist their client’s arms to settle for less.

Advertising (even lawyer advertising) can be helpful to consumers, especially when it educates and informs. But when lawyer advertising provides no useful information and page after page in the yellow pages (and on the front and back cover of the telephone book) say essentially the same thing, choosing the right lawyer turns more on guesswork than on good information. Empty slogans such as “No Recovery, No Fee” or “Free Consultation” mean little when nearly every lawyer who handles car accident cases offers a contingent fee agreement and a free initial consultation. Likewise, tag lines like “We Care” or “Aggressive” or “We’ll fight for you” offer consumers nothing more than the bare minimum you ought to expect from any lawyer worth his salt.

A decision as important as the right lawyer for you and your case must be based upon more than the size and color of a yellow page ad or its placement in or on the telephone book. Anyone serious about obtaining full and fair compensation should consider more than the telephone book before deciding about a lawyer.

The filing of frivolous lawsuits hurts everyone by delaying legitimate claims from getting to court and – even worse – tainting juror attitudes towards deserving injured people. If you do not have a case worthy of suit, your lawyer should tell you as soon as possible. You deserve an honest evaluation. On the other hand, if your claim has merit, you will learn quickly that the attitude of adjusters and juries towards frivolous lawsuits will be something that you must overcome. When frivolous claims are minimized, justice will be made easier to achieve for those genuinely harmed by inattentive drivers.

Another challenge which stands between you and justice are the lawyers and law firms (often with large advertising budgets) with reputations for handling hundreds of cases at a time who make promises that cannot be kept. There are lawyers who never go to court and settle every case to collect an easy fee. The insurance companies know who they are (and love them). You should know who they are, too (and avoid them like the plague).

Before You Even Pull Out of the Driveway

Why the Car Insurance You Buy Matters

In Pennsylvania, your car insurance coverage provides the framework within which your car accident claim will be handled. Your coverages (or lack of appropriate coverages) are literally in place before you even pull out of your driveway. Unfortunately, knowing what car insurance coverages to buy can be anything but straightforward.

We could make the purchase of auto insurance coverage the subject of a whole separate book. Instead, we present here just a summary of what we believe to be the most basic (yet important) things about auto insurance coverage in Pennsylvania.

It is not our intention to tell you how or what to buy. Really, that’s a decision that you can only make in consultation with your insurance agent. However, we will offer information that will help you to make the best decisions possible for you and your family.

If you already have car insurance, it might be helpful for you to pull out your “Declarations Sheet” (a document which accompanies your insurance policy that describes the coverages you bought) and use it as a reference as you read through this section. We organize our discussion here in the format in which it is most often set forth in a typical Pennsylvania auto insurance declarations sheet.

In Pennsylvania, the law requires drivers to have only three different types of coverage: (1) coverage that protects you if you damage someone else’s vehicle; (2) coverage that protects you if you hurt someone else; and (3) coverage that pays your medical bills if you are injured in a car accident. Further, the law requires only that drivers buy certain minimal amounts of each of these coverages. The minimum coverage required by law is shockingly low. We will discuss your options to purchase additional amounts and types of coverage beyond the statutory minimums. In the process, we will make clear as we go which coverages and amounts are mandatory, which are optional, what we buy for our families and recommend to our friends, and why. We begin, however, with a topic that is so important (and yet so often misunderstood) – the “Limited Tort” option.

Does Choosing “Limited Tort” Really Save You Money?

In Pennsylvania, every time you buy a policy of insurance you will be asked whether you would like to choose the “Limited” Tort option (instead of the Full Tort Option). A written notice you will receive tells you that if you choose limited tort, you and your household members will not be able to recover “non-monetary damages” for an injury unless your injury is “serious.” The notice also shows you that you will receive a modest discount on your insurance premium if you choose Limited Tort.

If you talk to your agent about this, you might hear something like this, “Limited Tort is a good idea. It’ll save you money on your policy. You and your family will still be able to sue if you get seriously injured. And most people don’t sue unless they’re seriously injured anyhow.”

So, you might think to yourself, “I’d never sue anybody for a minor injury. I think I’ll take advantage of the savings that comes with choosing Limited Tort.”

So, what’s the problem with Limited Tort? The problem is the way “serious injury” is defined by the law and the impact of the Limited Tort law in real life. The law defines “serious injury” as death, serious impairment of bodily function or permanent serious disfigurement. Insurance companies have used this law to prevent people with substantial injuries from recovering anything for their pain, discomfort and inconvenience.

In one Erie County case, a man suffered head and face injuries when a commercial truck driver lost control and collided with his vehicle. His injuries included facial fractures to the orbital ridge of his skull that required the placement of bone stabilizing plates and screws. His doctors also testified that he had a brain injury that affected his memory and his ability to perform somewhat complex tasks (like reading a map or balancing a checkbook).

The careless driver’s insurance company claimed that these were not “serious” injuries (as defined under the law) and the man with the broken face lost his trial, receiving nothing for his pain and suffering. The man with plates and screws in his head plainly didn’t save any money when he chose Limited Tort.

This is unfortunately not an uncommon occurrence for consumers who buy Limited Tort. Insurance companies have claimed that many substantial injuries did not meet the definition of serious injury. Some examples of injuries that were not deemed to be serious include broken legs; fractures that required the placement

of plates and screws; broken ribs; a damaged spinal disk that permanently kept the injured person from walking more than a block at a time, working more than part-time, or bathing her daughter; scarring of the eye area; and lost hearing. The people who sustained these injuries didn’t save any money when they bought Limited Tort.

Most people would think that broken legs with the placement of bone screws and plates would qualify as a “serious” injury. And most people probably wouldn’t give up their right to be compensated for such an injury. But if you choose Limited Tort, you can bet the other guy’s insurance company will claim that you are not permitted to recover compensation for your injury, almost no matter how serious it really is.

The good news is that it’s not too late to change your mind. You can call your insurance agent today and change your tort election from Limited Tort to Full Tort.2 Not only will you be preserving your right to compensation but you’ll be preserving that right for the other people in your household, too.

It should be apparent by now that the Limited Tort option often costs people harmed by careless drivers far more than they hoped to save. It has caused more injustice, in our view, than it has saved money. We don’t choose Limited Tort for ourselves or our children and we do everything we can to keep our friends and family from choosing Limited Tort. Instead, we buy the Full Tort option for ourselves and our family and encourage our friends to do the same.

2 Always send a letter to your insurance representative to confirm your request for Full Tort.

However, this message might be getting to you too late. If you’re subject to the Limited Tort option (either because you chose it or someone in your household chose it) and you’ve been injured in a car accident, it is worth finding out if your injuries are such that you have a chance to get past the “serious” injury requirement and it’s also worth finding out if your case falls within one or more of the exceptions. You should consult with a knowledgeable and experienced lawyer to get the answers to these questions.

Are You Stuck with “Limited” Tort?

You might not be stuck with “Limited” Tort because there are exceptions to the “serious” injury requirement. These exceptions include:

- When the at-fault driver is convicted of DUI or accepts ARID after being charged with DUI;

- When the at-fault driver is operating a motor, vehicle registered in another state;

3. When the at-fault driver has acted with the intent to injure himself or another;

- When the at-fault driver has violated the law’s requirement to have insurance;

- When the injured person is occupying a vehicle that is principally used for commercial purposes (other than farming);

- When the injured person is occupying a vehicle that is owned by a corporation or other legally created entity;

- When you or the person who elected the Limited Tort option didn’t sign the form required by law, or the election form that you signed was legally inadequate;

- When the injured person is a pedestrian; and

- When there are competing tort options that apply (under some circumstances).

This list of exceptions is not exhaustive. There are other circumstances not listed here when the Limited Tort option may not apply. If you think you might be stuck with Limited Tort, consult a qualified lawyer. An exception to the general rule might spare you an injustice.

Some of the Best Kept Secrets in Car Insurance

Liability Protection – Bodily Injury. The Liability Protection section of your declarations sheet should show two different coverages, Bodily Injury and Property Damage. Bodily Injury Coverage is the coverage you buy to protect yourself if you (or another insured like a family member) hurt or kill someone else as a result of careless driving. In Pennsylvania, all drivers are required to purchase this coverage but the minimum amount needed is only $15,000 per person and $30,000 per accident. If you are found legally responsible for harm which is greater than the coverage that you purchased, then you will be personally responsible to pay for any harm that exceeds the limit of your insurance coverage.

Serious injuries and death almost always result in verdicts more than $15,000. People who own assets (like homes) want to protect them from judgments that can result from accidents that they cause. The cost of such protection – in the form of additional Bodily Injury Coverage – is modest. For example, on our policies, the difference between buying the legal minimum and buying coverage up to $250,000 per person and $500,000 per accident was $4.10 per month.3

We recommend that you give serious consideration to buying more than the statutory minimum. As with many of the other optional coverages we discuss in this section you may be surprised at how affordable these optional (yet extremely important) coverages can be.

Liability Protection – Property Damage. Property Damage coverage is the other liability coverage you are required by law to buy in Pennsylvania. Property Damage liability coverage is the coverage that protects you in the event that you cause damage to someone else’s property (like another car) as a result of carelessness. The minimum you must purchase in Pennsylvania is only $5,000 per accident.

3 Here, we will give you examples of premium differences we find on our own policies. Often, we observe that the additional premium required for optional or additional coverage is surprisingly modest. However, the amounts that we recite here are merely examples. The actual differences depend on the company issuing the policy, the vehicles being insured, the risk history of the policyholders and other factors. You should talk to your insurance agent to determine the actual cost differences that would apply to a change in your coverage.

Unfortunately, the cost of repairing or replacing today’s cars frequently exceeds $5,000. Fortunately, property damage coverage is stunningly inexpensive. On our policies, the difference between the legal minimum and enhanced coverage of $100,000 per accident was seven dollars…. per year! That’s right, the difference between coverage of $5,000 per accident and $100,000 per accident was less than 60 cents per month.

This coverage is not, in our view, the most important coverage you can buy. By its nature it tends to deal with less important subject matter (property) than the other coverages we discuss (bodily injury). But the cost of meaningful additional levels of coverage is so affordable we would be remiss if we failed to bring it to your attention.

First Party Benefits – Medical Expense. First Party Benefits are usually the next group of coverages listed on a declaration sheet. This coverage includes Medical Expense Coverage, Income Loss Coverage and Funeral Coverage. First Party Benefits are coverages that will be paid to you without regard to fault. In other words, your insurance company will make payment to you as required by the terms of these coverage provisions, even if you caused the accident.

Medical Expense Coverage is required by law on all auto policies. The minimum amount you must buy is only $5,000. Medical Expense Coverage pays medical bills that may result from injuries you (or someone insured under your policy) suffers in a car accident.

Our experience has been that it doesn’t take much of an injury before the treatment expenses exceed this minimum coverage, particularly if there is any long-term treatment like physical therapy required. If you have excellent health insurance then you may not need more than the state minimum. However, if you do not have health insurance or you have reservations about the adequacy of your health insurance, then you should consider increasing your Medical Expense coverage beyond the statutory minimum.

On our policies, the difference in premium between the minimum required by law and an increase in coverage to $100,000 in medical expense benefits was $4.30 per month.

First Party Benefits – Income Loss. Income Loss (sometimes called “Wage Loss”) coverage is not required by law. If you have this insurance on your policy, this coverage will pay you 80% of your average monthly earnings in the event that you are hurt in a car accident and unable to work. Like the other first party benefits, this coverage will result in payment to you even if the accident was your fault.

If you don’t have income loss coverage and you are injured and unable to work, you will be entitled to recover lost income from the at-fault driver. However, you will not recover for this loss until your case is settled. In other words, even if you are not at- fault, you will have to wait months or years to recover your lost wages. Of course, if you don’t have income loss coverage and the accident was your fault then you will not be entitled under your auto policy to recover for lost earnings.

Your need for Income Loss Coverage will depend on your current earnings, your financial well-being and other insurance that you have which covers you when you cannot work (like short term and long-term disability policies). You should discuss these details with your insurance representative. However, we’re inclined to recommend that you have at least some income loss coverage (at least enough so that your family could maintain an acceptable standard of living if you were off work for an extended period of time).

On our car insurance policies, our premium for Income Loss Coverage that would pay up to $2,500 per month and a maximum total of $50,000 is $21 per year.

First Party Benefits – Funeral Benefit. Funeral Benefit Coverage will provide reimbursement of funereal expenses to you or your family in the event an insured is killed in an auto accident. It also is inexpensive. On our policies the premium for $2,500 in coverage is $1 per year. However, the coverage is very small. Whether you should have Funeral Benefit Coverage turns on whether or not you could afford a funeral in the absence of this coverage.

“U” Coverage. “U” Coverage is a short-hand way of referring to Uninsured Motorist Coverage and Underinsured Motorist Coverage. These coverages are not required by law. However, they are tremendously important, in our estimation, and should be purchased by everyone in Pennsylvania for reasons that we will discuss.

Uninsured Motorist Coverage. Uninsured Motorist Coverage is the coverage that will protect you if you are harmed by a driver who has no insurance. If you have purchased this coverage and an uninsured driver injures you, your insurance company will pay to compensate you for your injuries.

There are countless uninsured drivers in Pennsylvania despite the fact that the law requires every driver to be insured. One national study found that 1 in 6 drivers in the United States is uninsured. Further, we’ve observed that these illegal drivers seem to be involved in a disproportionate number of serious accidents which cause great harm to innocent drivers, passengers, pedestrians and cyclists. So, there is a significant risk that the at- fault driver in a car accident will have no insurance to pay for the harm that he causes. This means that if you don’t have “U” coverage, no one will pay for the harm caused to you.

Here is how Uninsured Motorist Coverage works. Let’s say a fictional woman named Jane is stopped in a line of traffic while waiting for the light to change. A drunk driver rear ends her vehicle at high speed and causes Jane to suffer injuries to her leg and face that require surgery and leave her scarred and with a permanent limp. The drunk driver has no insurance.

If Jane has Uninsured Motorist Coverage then her insurance company will be obliged to pay her, up to the limits of the coverage that she bought, the amount the drunk driver would legally have been responsible to pay her. However, if Jane doesn’t have “U” Coverage and the drunk driver has no assets (and many uninsured drivers don’t) then there may be no way for Jane to get any compensation for the harm she suffered.

In Pennsylvania, Uninsured Motorist Coverage is optional. But we highly recommend that everyone purchase no less than $100,000 per person and $300,000 per accident. You might be wise to buy even more of this sort of coverage depending upon your personal circumstance. We purchased Uninsured Motorist Coverage of $250,000/$500,000 for an annual premium of $20.

Underinsured Motorist Coverage. Underinsured Motorist Coverage is similar to Uninsured Motorist Coverage. The distinction between the two is that Underinsured Motorist Coverage applies when the at-fault driver has some insurance, but not enough.

It works this way. Remember our fictional young motorist named Jane who was disfigured by the drunk driver? Assume now that, instead of being uninsured, the drunk driver who collided with Jane had only the mandatory minimum coverage of $15,000 per person, $30,000 per accident. With fractures, permanent scarring and permanent impairment, Jane’s case would have a value far in excess of $15,000. However, because the drunk driver had only $15,000 in coverage, that is all the drunk driver’s insurance company would pay her.

If Jane had Underinsured Motorist Coverage, then her own insurance company would pay the difference between what she was entitled to receive and what the drunk driver’s insurance company can pay her. However, if Jane didn’t have Underinsured Motorist Coverage and the drunk driver had few or no assets, then Jane would not be likely to recover full and fair compensation for her injuries.

There are many, many underinsured motorists in Pennsylvania. Because the Commonwealth’s mandatory liability limits are so low and because many people only buy as much insurance as the law requires, there are far too many people who cause accidents and do not have enough coverage to compensate the people that they harm.

The premium charged by insurance companies for this coverage reflects how common it is for insurance companies to have to pay underinsured motorist settlements, i.e., Underinsured Motorist Coverage is much more expensive than Uninsured Motorist Coverage. Our policies include Underinsured Motorist Coverage of $250,000 per person/$500,000 accident and cost $162 per year. Like Uninsured Motorist Coverage, Underinsured Motorist Coverage is something we have no hesitation in recommending. We believe that everyone should have at least $100,000 per person/$300,000 per accident.

The Stacking Option. Stacking is an option on Pennsylvania automobile polices that allows people with more than one vehicle to inexpensively increase the limits of Uninsured and Underinsured Motorist Coverage. Stacking is not required by law.

If you elect to “stack” your coverage then your “U” Coverage will be equal to the sum of the coverage that applies to all your vehicles. In other words, if you have Uninsured/Underinsured Motorist Coverage of $100,000 per person/$300,000 per accident and you own two vehicles, when you choose “stacking” then your total coverage would be $200,000 per person/$600,000 per accident.

The cost of stacking is relatively modest. Our premiums for the stacking option are not itemized and so we cannot share with you exactly how much we pay for this additional coverage. If you own more than one car then you should ask your insurance agent about “stacking” and its cost. We expect you will find it is an affordable way of substantially increasing your coverage.

Physical Damage Coverages. Comprehensive and Collision Coverages are often the most expensive aspect of your insurance policy even though the risks to which they apply (damage to your car) are comparatively minor when compared to the risk of catastrophic personal injury. (In other words, aren’t life and limb more valuable to you than stuff that can be repaired or replaced?) Nevertheless, the cost of these coverages can sometimes be managed by increasing your deductible.

Collision and Comprehensive Coverages are not required by law although your bank or financing company will frequently require you to have both. These coverages protect you from damage to your vehicle resulting from collisions, fire, flood, hail, theft and other itemized losses.

Gap Coverage. A related coverage that is sometimes available on your auto policy and more often made available as a separate policy by financing entities like banks or credit unions is “Gap” coverage. Gap coverage is a product designed to cover the difference between what your Collision Coverage would pay and what you owe on the vehicle. Because Collision Coverage only pays up to fair market value and because a vehicle’s value often drops as soon as you drive it off the dealer’s lot, there can be a difference (or “gap”) between the amount you will be paid by your insurance company and the amount you owe on your car loan. Coverage for this “Gap” is sometimes available from your insurance company and almost always offered by a financing company.

Catastrophic Loss or “Umbrella” Policies. These policies are available as a means of inexpensively increasing your liability coverage (and sometimes your Uninsured/Underinsured Motorist coverage) beyond the limits purchased on your automobile policy. Typically, these policies ensure you for risks beyond those covered by your auto policy. For example, a Personal Catastrophic Loss policy might provide liability coverage for liability otherwise covered by a homeowner’s policy or a maritime policy. Unless specifically stated these policies usually don’t apply to business activities. You’ll have to discuss the precise coverage with your insurance representative.

The thing to know about Catastrophic Loss or “Umbrella” policies is that they exist and are worth asking your agent

about. Frequently, they are very inexpensive when compared to the coverage they

provide. (We pay about $200 a year for an additional $1,000,000,000 in

coverage). You should ask what such a policy would cost, whether it would

increase your Uninsured/Underinsured Motorist Coverage (or whether a separate rider is available

for this coverage)

and to what liabilities it

applies (and does not).

After the Crash

10 Things “To Do” at the Accident Scene

The most important steps to take after a car accident are those that prevent further harm and those that help to fix the harm that’s already occurred. After that, you want to collect information and make sure the information you share with others is accurate.

- Check for injuries. Are you hurt? Is anyone in your car hurt? Does it appear (without getting out of your car) that anyone else has been hurt? Before you do anything else, determine whether anyone requires emergency assistance. When in doubt, call 911 and ask for an ambulance.

- Warn others & protect yourself. Put on your hazard lights or what our parents called “four-way flashers.”

- Stay near, but safe. If the accident was a minor one and there appears to be no serious injury, move your car to the side of the road and away from traffic. If you’re injured or your car cannot be moved, you and your passengers should stay in your car with your seatbelts on.

- Seek help. Call the police, even for minor accidents. Or ask that a bystander or passerby call for help if you are hurt or do not have a mobile phone. Not every jurisdiction requires a police response to every accident but it’s always best to report the accident anyway.

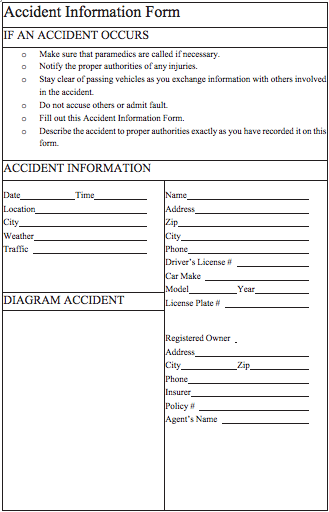

- Trade information. Exchange information with others involved in the accident. Consider using the form at the end of this chapter. The information you should expect from others, and should be prepared to share, includes: name, address, phone number, insurance company, policy number, and driver license number for all involved drivers; name and address of all vehicle owners; name, address and phone numbers of witnesses; and license plate numbers of all vehicles.

- Be polite and factual. When speaking with the other driver and with any first responders like police it is important to be polite, cooperative, and to provide all required information. However, you should not accuse others of fault in the accident or volunteer that you are at fault.

- Take pictures. If you have a camera in your car or on your mobile phone, consider photographing the vehicles involved in the accident and the accident scene. But be careful! Don’t wander into traffic or take unnecessary risks while getting your pictures.

- Make notes. Take note of the make, model, year and color of involved vehicles; the location of the vehicles; and the precise way the accident occurred. If you haven’t spoken with witnesses yet, this is a good time to ask for their contact information. Remember, it’s alright to ask people for contact info and other information. Just don’t interfere with the police or medical personnel.

- Stay until told otherwise. Don’t leave the scene before the police and the other drivers do unless the police tell you otherwise. (Or unless there is a real emergency that requires you to leave. But do so only after you exchange information with others and you determine that those who need medical attention are getting help.) Leaving the scene of an accident can violate the Pennsylvania Crimes Code and result in criminal prosecution.

- Tell your insurance company. Notify your insurance company and/or agent after you take care of these other things. It’s not uncommon for people at the scene of an accident to agree to handle things themselves without involving their insurers. This is often not a good idea. Differences can arise after the fact, particularly when the at-fault driver sees the amount of the repair bill, or if there are injuries. Most motorists are usually better off when they notify their insurer promptly.

Answers to 10 Frequently Asked Questions

If you were injured in a car accident you may have questions like, “How will my medical bills be paid?” or “How will I obtain compensation for my lost wages.” Here, we answer these and other frequently asked questions.

- Who will pay my medical bills? In Pennsylvania, all motorists must purchase car insurance. All car insurance companies are required to provide medical benefits coverage of at least $5,000 as part of every car insurance policy. (You can buy more coverage. Insurance companies must, by law, be willing to write policies with medical coverage as high as $100,000.) This coverage does not depend on fault, or who caused the accident. In other words, who caused the accident does not determine which insurance company pays your medical bills. Instead, this medical coverage is available based upon your relationship with the insurance company.

Your relationship with the insurance company

could be as a “named insured” or as an “insured.” You are a “named insured”

when your name literally appears on the declaration page of the car insurance

policy. If you are a named insured on a policy, then that policy’s insurance

company will pay your medical bills up to the limit of medical coverage that

you purchased. If you’re not a “named

insured” but qualify as “an insured” under a policy, then that policy’s carrier

will pay your medical bills up to the same limit. If you’re neither a named

insured nor an insured, then the policy that covers the vehicle you were in at

the time of the accident will pay your medical bills up to the limit of medical

coverage purchased.

- What if my medical bills are more than the medical coverage limit on my car insurance policy? If your medical bills exceed the limits of the medical benefits coverage, then your health insurance company should pay whatever bills are not covered.

- Who pays the medical bills for pedestrians or bicyclists who are hit by a car? If you were a pedestrian or bicyclist at the time of the accident and you don’t have any insurance, you are entitled to have your medical bills paid by the insurance company for the car that hit you.

- Can I recover the value of my lost wages? If you are unable to return to work because of injuries suffered in a car accident, then you may be entitled to reimbursement, regardless of fault, from an insurance company if the applicable policy offers “Income Loss Benefits.” Income Loss Benefits are not required by law in every car insurance policy, although insurance companies are required to at least offer this coverage as an option. If Income Loss Benefits are an option on the insurance policy that covers you, then you will be entitled to recover 80% of your actual gross income loss up to the limits of the coverage. If you are self- employed, then you can recover the cost of hiring substitute or special help.

- What if there isn’t enough insurance to pay all my medical bills and lost wages? If your medical bills or lost wages exceed your coverage and you don’t have health insurance, you are entitled to recover these costs from the careless driver’s insurance company. The process of recovering from an at-fault driver can be more complex and take longer than collecting directly from the first party benefits coverage on an insurance policy.

- Do I have to reimburse my health insurance company if I settle my case? In Pennsylvania, health insurers are generally not entitled to be repaid for medical bills they paid that arose from a motor vehicle accident. However, as with most general rules, there are exceptions. Here are the most common: a) ERISA qualified, self-funded plans, b) worker’s compensation insurance companies, and c) state or federally funded plans. There are other, less common, exceptions too. Sometimes, the amount that must be repaid can be reduced through negotiations. This, of course, benefits you and allows you to keep more of the settlement. Before you agree to settle your case, you should ask your lawyer whether any medical payments in your case must be reimbursed and whether a compromise can be negotiated.

- What about compensation for my pain, discomfort, inconvenience, disfigurement and embarrassment? If you chose the Full Tort option (or fall under one of the exceptions to the Limited Tort option)4 when you purchased your car insurance, you are entitled to be compensated for all harm caused by the negligent, or careless, driver who caused the accident. Your compensation is paid, not by the inattentive drive, but rather by his insurance company. The purpose of the law is to fix what can be fixed (like repaying lost income or medical bills); to help what can be helped (like paying for treatment that lessens but does not cure a problem); and to make up for what cannot be fixed or returned to you (like pain, discomfort and the loss of the things that one typically enjoys as a healthy person).

4 For more on this subject, read Are You Stuck with “Limited” Tort section

- How will my lawyer be paid? There are two ways to pay your lawyer (although one is used far more often than the other). The first method pays your lawyer solely upon the amount of time he devotes to your case. The time is billed at an hourly rate. Often, there will be an advance fee or retainer paid before the case begins and invoices issued to you periodically as the case proceeds. The downside of this approach is that you must pay in advance and as the case is being prepared. Many people do not have adequate savings to pay a lawyer in this manner. Also, people who are harmed by a careless driver often experience an interruption or reduction in their earnings because they miss work, remain in the hospital or in a rehabilitation program, or work less due to their physical problems. Thus, the second method, the contingent fee agreement, is the far more common way to pay lawyers who pursue justice for people harmed by inattentive drivers.

A contingent fee agreement requires the lawyer to work on your case without payment either in advance or during the preparation of your case. The fee is based upon the results obtained, and fees are not paid as the lawyer prepares the case. Instead, the lawyer’s fee (if any) is paid only at the end of your case and set as a percentage of your recovery. If there is no recovery, then you don’t pay the lawyer any fee at all.

Although some lawyers talk about a “standard” contingent fee agreement, there really is no such thing. The percentage charged by lawyers typically ranges from 33 1/3% to 40%. All – or virtually all – lawyers who handle personal injury cases offer a contingent fee agreement. Some lawyers will offer a fee schedule that charges a lower percentage if your case requires less work or if they expect a large recovery. For example, read The “Client Friendly” Fee Agreement: A Different Way to Set Lawyer Fees in Accident Cases at page 68.

A fee agreement must be in writing and should be signed before your lawyer begins work on your case. You should be sure to read and understand the agreement before signing. In addition to the fee, you also will be required to reimburse the lawyer for so- called “out-of-pocket” expenses incurred to hire investigators, expert witnesses, stenographers or to file papers with the Court. These expenses often must be reimbursed, even if you lose your case and don’t pay the lawyer any fee.

- How long will my case take? The amount of time necessary to resolve a car accident case in Pennsylvania varies greatly from case to case, literally ranging from a few weeks to a few years. The reasons why one case might take longer than another include the complexity of the issues in the case, the degree of injury relative to the available insurance coverage or the time it takes to fully appreciate the impact some injuries have on your life and the lives of your spouse and children. If you ask a lawyer about how long your case should take, you shouldn’t get an answer that defines the time in months and you certainly shouldn’t get any guarantees. But a lawyer ought to be able to tell whether your case is likely to be one that can be quickly resolved or is more likely to be one that will take more time (and, of course, the lawyer should explain why).

- Will my case go to court? There’s an old saying among lawyers that goes something like this: “Lawyers who hope to settle often end up facing trial, while lawyers who prepare for trial often see their cases settle.” The point is that trial is the end game that drives the settlement process. The better your lawyer prepares for trial, the more likely it is that your case will settle. Whether your case is one that should settle or go to trial is a question your lawyer cannot answer when you first meet. A lawyer simply lacks enough information to make an intelligent estimate so early in the process.

The fact remains that most cases settle. In fact, the numbers are overwhelming. A recent study of federal court filings suggested that only about 2% of filed cases went to trial. A recent one-year sample of Erie County cases suggests that the rate of settlement may be even higher, with only 1% going to trial. Now, there is a difference between a fair and just settlement and any other settlement. With apologies to Mark Twain, the difference between the two can be as stark as the difference between lightning and a lightning bug.

What You Must Prove to Win Your Case

Just because you were hurt in an accident doesn’t mean that you are entitled to money for your pain and discomfort, even if your injuries are serious or permanent. While some insurance coverages must be paid to you regardless of who was at fault in the accident, a recovery for bodily injury requires that you prove that someone else was negligent. You must prove both that someone else was negligent (that is, careless) and that their negligence (or carelessness) caused your bodily injury. If you fail to do this, you will lose your bodily injury claim. If you prove that the other driver was careless, but cannot prove that such carelessness caused your injury, you will lose. If you prove that the accident caused your injury, but failed to prove that the carelessness of the other driver caused the accident, you will lose.

It is also worth mentioning some other things. If you sue the wrong person, you lose. If you wait too long to file suit, you will lose. If you had an injury before the accidents, then you are only entitled to be compensated to the extent your injury is now worse (if you can prove both that someone else was careless and that their carelessness caused your old injury to become aggravated). If both you and the other driver were careless, then the amount that you can recover for injuries caused by the accident will be reduced based upon the amount of your comparative negligence. In other words, the amount of culpability will be apportioned as a percentage of fault. You will recover only the percentage of your harm for which the other driver is responsible if you are not more to blame for the accident than the other driver.

8 Tips for Dealing with Your Insurance Company

NOTE: These suggestions do not apply to your dealings with the careless driver’s insurance company (i.e., the other guy’s insurance company). There is more on that subject later.

If you were recently in a car accident and are lucky enough not to be seriously injured, you’re still guaranteed a lot of inconvenience. These tips can help you minimize any inconvenience (and the risk of not receiving what you deserve) by showing you how to work effectively with your insurance company.

- Tell your insurance company. The first thing you need to do is promptly notify your own insurance company. Every policy requires some reasonably prompt notice of an accident and, if you fail to provide this notice and the delay hurts your insurer’s ability to investigate the case, you may lose your rights under your policy. Sometimes, in small accidents without serious injuries, people agree at the accident scene to handle it themselves and not involve their insurance companies. Often, these agreements crumble when the repair bill is presented. Other times the other driver turns it into his carrier anyway. On balance, it’s better policy to promptly notify your carrier after every accident. You can notify your local insurance agent or telephone your company’s claim department. There’s typically a phone number on your insurance card.

- Tell the truth (even when it hurts). When you speak to your insurance company there is one rule that stands out from all others. Always, always, always tell the truth. The reasons people sometimes tell something other than the truth are many and can include the best of intentions. Sometimes people don’t want to reveal embarrassing personal information. Sometimes they’re trying to protect someone else. Sometimes they think (usually wrongly) that the truth might jeopardize their coverage. If you tell your insurance company something other than the truth, then you risk many consequences, including a loss of your insurance coverage altogether and even criminal prosecution.

- Just the facts. Be clear and factual in your communications. It won’t help you to blame the other driver, and it can hurt you to accept fault. Just tell the adjuster exactly what happened in language that is clear, accurate and complete.

- Did you remember to buy rental insurance? If you have rental coverage, find out what your coverage will pay, and rent the best car your coverage allows. Be sure to inquire about whether your policy provides coverage for your rental car. Policies vary in this regard. If your policy doesn’t provide rental coverage, buy the optional coverage offered by the rental company.

- Your car must be repaired to its pre-accident condition (that is, if you bought collision coverage). In Pennsylvania, your insurance carrier is required to pay for the repairs necessary to return your vehicle to its pre-damaged condition and, if that cannot be done, to total the vehicle.5 You are entitled to choose the person who will perform the repairs. So, if you doubt that the repairs will return your vehicle to its pre-damaged condition, raise your concerns with the appraiser and the adjuster assigned to your claim.

- Know the fair value of your car. If your car is totaled, make the effort to know what your car was worth before the accident. Pennsylvania requires insurance damage appraisers to follow one of three defined approaches to determining actual cash value. Typically, appraisers average book values (using sources such as the NADA Official Used Car Guide) but they can also consider actual sales prices of similar cars or, more rarely, the opinions of local car dealers. Do your own research and tell the appraiser if you think something has been overlooked or wrongly priced.

5 This presumes that you bought Collision Coverage.

- If you caused the collision, your insurance company will defend you. If you were at-fault in the accident and someone was injured, your insurance company will pay a lawyer to defend you throughout the lawsuit, including a trial. And your insurance company will pay up to the limits of the bodily injury insurance coverage available under your policy to compensate the injured person in the event of a settlement or verdict. However, if it appears that your policy limits are not enough to fully compensate the injured person, you may want to hire your own lawyer to advise you and to serve as a liaison with your insurance company.

- If you cannot resolve the property damage claim. If you are unable to resolve disputes with your insurance company (for example, if you can’t agree on the actual cash value of your vehicle) you have options available to you. Oftentimes, your company will have a consumer representative with whom you can speak. If that doesn’t work, some policies have dispute resolution procedures such as mediation or arbitration. You can also contact Pennsylvania’s Insurance Department at 1-877-881-6388 or http://www .insurance .pa .gov/portal/server .pt/community/ insurance_department/4679.

WARNING: The Other Guy’s Insurance Company Will Call – Then What?

It is true that a lawyer who represents himself has a fool for a client. And that also applies to everyone else who attempts to represent themselves.6 We want to be sure our message comes through loud and clear. We strongly advise you to get a lawyer (at least talk to a few) before talking to any insurance company. Still, we know that some of you out there (you know who you are) won’t believe a pan is hot until you’ve touched it yourself no matter how many times you’ve been told. So, here are some tips for those of you who just have to touch that pan.

6 We recognize a limited exception to this advice that applies when the claim is for property damage only or for extremely minor injuries. In those cases, the cost of legal representation may not be warranted.

- Always, always, always tell the truth. Even when it is embarrassing to you, even when you think it hurts your case, even when you think it hurts someone else, the truth is the best and only thing you should tell an insurance company in connection with a claim.

- They are not on your side. Remember that the other guy’s insurance company and its employees are not on your side. No matter what they say, they are not trying to help you. They are not going to give you the benefit of the doubt. They aren’t supposed to lie to you, but they have no obligation to be fair to you.

What will the other guy’s insurance company do? The short answer is that they will deny, delay and dispute your claim at every turn. They are going to do everything in their power to blame you for the accident and to minimize the value of your claim. It is always a “zero-sum” game for the insurance companies. The less you get, the more they save and the more profitable they remain.

That’s their job and they do it well. See, The Bull & the Vegetarian (And Other Cautionary Tales) at page 4 and Big Insurance Companies Behaving Badly at page 6.

- Some things you just cannot know right now. Your initial conversations should be polite but controlled. Until you complete your treatment and accident investigation, you should limit the information you provide to your name, address, phone number and limited accident information (e.g., date, time, place). Naturally, the insurance investigator will want to know about your injuries and the details of the accident. But, at least in the early going, you can’t be sure of the full extent of your injuries and you may not have completed your accident investigation. It’s appropriate to say that you don’t know exactly how severe your injuries are and that you are following up with your doctors. You will provide more detailed information in your demand.

- No written or recorded statements. Don’t agree to give a recorded statement – not in person and not over the phone, and don’t sign a document that purports to be a summary of your words. You might ask yourself, “Has the insurance company offered to let me record a statement from their insured, the other driver, the one who caused the collision?” No, of course not. This is a one-sided process aimed at getting you to make statements that are harmful to your case. The insurance company will assign someone whose only interest is in eliciting words from you that can be used to make it seem you bore fault in the accident or that can be used to limit your harm. In sum, there’s little good (and a lot of bad) that can come from agreeing to give a recorded statement.

- If you insist, at least do these things. OK, we know some of you might give a recorded statement anyway. After all, you ignored our advice about getting a lawyer. And the insurance company will tell you that they won’t deal with you without a recorded statement. So, if you still insist on this, here are a few tips for the recorded statement. (But when it goes badly you cannot be heard to say that nobody told you so.)

- Make sure you both hear and understand the question. If not, ask for the question to be repeated or rephrased.

- Think about the question. Pause before answering.

- Think about your answer.

- Answer the question you’re asked completely and clearly.

- Speak audibly. (No nodding or head shakes, no “uh-huhs or uh-uhs.”)

- Don’t volunteer information.

- Only provide information that you know personally. That is, you only know what you saw with your own eyes, heard with your own ears or felt with your own body.

- Don’t guess. If you don’t know the answer, then your answer is “I don’t know.” This is particularly true of questions about time, distance and speed. If you know how many seconds there were between the time you first saw the other driver’s car and the time it collided with you, you can tell the questioner. But don’t say, “A couple of seconds” if what you really mean is, “I’m not sure, it wasn’t very long.”

- When you’re not certain, make sure you say that you’re not certain.

- Don’t answer questions with assumptions.

- Make each question and answer complete by themselves so that, if read out of context, your answer accurately conveys your position.

- Straighten out confusion and clarify multiple meanings.

- Be polite but not familiar or chummy or attempt to be funny.

- Remember the first rule of all insurance company communications is always tell the truth and especially when it’s uncomfortable.

- Authorizations must be limited and only given upon two conditions. You will be asked to provide authorizations that allow the insurance company to collect your medical records. This effectively permits them to see personal records, including mental health and other intimate records. If you agree to disclose such information, you should do so only upon the conditions that the insurance company agrees to provide you with copies of all documents that they collect using your authorization and that they do so without cost to you.

- Know what the law requires. This is a tall task but an essential one if you intend to obtain justice. The law requires the culpable driver to pay for all harm caused by the accident. Such harm, or damages, can include past and future medical bills, your past and future lost wages, the damage to your property and the cost of lost opportunities. The law also requires that you be compensated for the pain, discomfort, inconvenience, embarrassment, humiliation, loss of the enjoyment of life and other harm (past and future) which resulted from your injuries. This is the intangible harm that can be hard to quantify without experience in these cases. This is the tallest task for anyone seeking justice without the help and guidance of a good lawyer.

- Your own carelessness can reduce your award. If you were partly at fault for the accident, recognize that your damages should be reduced by the percentage of your fault.

- Make a written demand. After you’re sure you know what your injuries are and what the future is likely to hold for you, be prepared to make a written demand in which you tell the insurance company the details of the accident and your injuries and what you think your case is worth.

- Pay any liens. Remember that there may be people who are entitled to be repaid.

If at any time you feel that you’re in over your head or that you’re not getting the response you’d

hoped for, you can call a lawyer. An experienced personal injury lawyer should

be able to tell you candidly whether he or she can help you to do better than

you’ve already done for yourself.

Honesty is (Still) the Best Policy

Caveat Emptor Is a Good Policy, Too

When my wife and I were first married, we took a trip to another country where some college friends of ours lived and worked. Our friends took some time off work to show us their homeland.

One afternoon we were in an open-air market. My wife was looking for some hand-made silver jewelry and she understood that this market was the place to go for such things. As we walked through the market we saw many booths where vendors hawked their wares, including many selling silver jewelries. My wife stopped at one and listened to the vendor. But our friends pulled us away. They explained that the jewelry at this vendor was neither hand-made nor was it silver (rather it was hollow, silver-plated and factory made).

Our friends led us to other vendors who they knew to be reputable. My wife found what she liked and was ready to buy but our friends intervened. “You do not pay their asking price,” they explained. “No one pays the asking price. You must bargain with them. You must not reveal that you want it. You must tell them that you know other vendors who have the same jewelry. Offer them half. Then walk away. They’ll follow you and then you buy.” My wife followed their advice and was pleased that the vendor played along just as our friends had advised. She ended up getting what she wanted and at a price about half of what she would have otherwise paid.

My wife and I were not new to buying things. Nor were we new to negotiating. But we’d never been in that country before and were not silver jewelry experts. Had it not been for our friends, we might well have paid much more than we should have or, worse, bought the fake jewelry. It reminds us that everyone could use guidance from someone who is familiar with the territory.

The presentation of car accident claims is foreign ground to most people. It is an adversarial process, which means that the insurance companies you deal with have no obligation to be fair to you or even consider your best interest. While they’re not supposed to lie to you or act to deceive you, they generally have no obligation to share important information with you, to act reasonably in their interpretation of the law or the facts in your case, or to make you a settlement offer that reflects their true valuation of your case. In other words, you are expected to look out for yourself.

Here, we share some of the mistakes we see that can weaken or even ruin otherwise meritorious car accident cases. These mistakes must be avoided, and usually can be with solid preparation and a firm understanding of why the truth must be your companion on the road to justice.

Five Mistakes That Can Wreck Your Car Accident Case

You wait at a red light, just like the other cars stopped in front of you. Your mind wanders. You smile as you think about weekend plans with your husband and children. Then, in a flash and without warning, an SUV plows into you from behind. Your body slams against your seat. The front of your car is propelled into the truck

stopped in front of you. Your air bag deploys and presses against your face. While lying on a gurney near the ambulance, the police officer tells you that the driver who hit you was changing a disc in his CD player and failed to notice the red light in front of him. Over the following months, your injuries cause you to miss work. You need more help from your husband than usual around the house. You have many doctor appointments and physical therapy sessions. An MRI reveals damage to your spine.

Seems like a so-called “open and shut” case of clear liability which caused genuine harm. What could possibly go wrong?

We have talked to other lawyers, judges and juries about why seemingly good cases were lost. Some of these cases were weakened – or even ruined – by mistakes that were completely avoidable. You can wreck your car accident case by making one or more of these five mistakes (even if you do everything else right).

- Exaggerating your injuries. You should assume that the insurance company for the inattentive driver that caused the accident will hire a private investigator to conduct videotaped surveillance of you and your activities. Such surveillance might include following you to and from the grocery store or the hairdresser or even your physical therapy appointments. If you claim that you cannot run, climb or stoop, and you get caught on videotape running, climbing or stooping, you lose all credibility. There is nothing more powerful than video proof that the accident victim has misrepresented her injury. The jury will spend far less time discussing the inattention of the driver or the impact of the car crash or your lost income, discomfort and inconvenience. Instead, the jury will focus upon whether anything you said can be believed – at all. And juries are unforgiving of someone they believe to be a liar.

- “Forgetting” previous accidents. As soon as you make a claim, the insurance company for the inattentive driver will want to know of any other accidents in which you were involved. The truth is that the other side probably already knows the answer. All insurance companies subscribe to databases which maintain this information. You will be asked whether you were involved in other accidents merely to test your truthfulness. If you attempt to hide information about other accidents from either the other side – or your own lawyer – you probably will lose your case. If you have been involved in other accidents, your lawyer can perform an investigation to determine if the other accidents create a real problem for your case. On the other hand, if you do not tell your lawyer and you misrepresent your accident history to the insurance company or their lawyer, you almost certainly will be painted as dishonest (even if the earlier accidents have no bearing on your case).

- Minimizing other injuries. You must be candid with your lawyer about any injuries that you suffered before or after this accident. You must assume that the other side will learn about any other health problems. In the past, if you received treatment for the other injuries – or even mentioned them to your doctor or other healthcare provider during a routine examination – there will be a medical record or office notation which exists to show this. And you can be sure that the insurance company for the other side will find this document. In most cases, your lawyer can deal with this if he knows about it; however, if you withhold such information from your lawyer and the insurance company or its lawyers find out about your other injuries, then both your case and your credibility will be ruined.

- Filing inaccurate tax returns. In many cases, such as the one described here, the person injured in an accident, through no fault of her own, will miss work. A loss in income will result. When you seek to recover lost income due to a car accident, your tax returns will be reviewed by the other side. If your tax returns understate your income, then it could be difficult to prove that your income loss is as great as you contend. This also creates an opportunity for your opponent to call into question your truthfulness should you under-report your income or overstate your deductions.

- Failing to follow your doctor’s instructions. Another common mistake occurs when you ignore or disregard the instructions of your doctor. Everyone (including juries) knows that doctors, nurses, physical therapists and other healthcare providers establish treatment plans for patients because they want their patients to get well. When you miss appointments, cancel appointments or discontinue therapy regimens before the doctor releases you, one of two conclusions can be drawn. Either you are not hurt and, therefore, require no treatment (or compensation), or you simply do not care enough about your health to follow the treatment plan. A car accident case in which the innocent driver is either not hurt or does not care provides the other side with no incentive to settle your claim. Such a case is also certain not to impress a jury.

Justice seeks truth. And the truth must always be on your side. Each of the mistakes that can wreck your car accident case involves something that you do or say which can be used to challenge your truthfulness. When you exaggerate or misrepresent or attempt to conceal information, however slight or innocent, you make a mistake that can ruin an otherwise strong case. Your candor begins with your first appointment with your doctor and continues throughout the entire case.